Nationwide Children’s Free Tax Prep Program Now a National Model

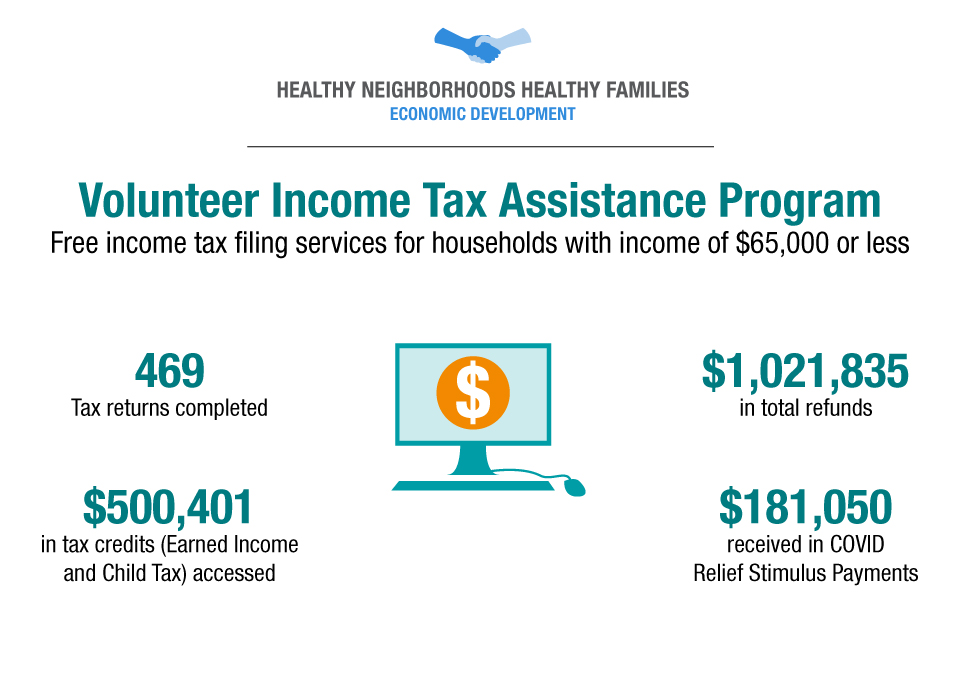

In 2021, just its second year, Nationwide Children’s Hospital’s free family tax preparation effort became perhaps the largest program of its kind – run by a pediatric health care institution – in the country. The hospital helped nearly 500 families receive more than $1 million in tax refunds in some of Columbus’s most under-resourced neighborhoods.

In 2022 and the years ahead, Nationwide Children’s program is poised to grow even bigger.

This large, early impact is a sign of just how much need is out there. But it also shows how well-positioned a children’s hospital is to meet that need, says Ed Miner, tax clinic coordinator and project manager of Healthy Neighborhoods Healthy Families. Healthy Neighborhoods Healthy Families is Nationwide Children’s nationally-prominent community investment program.

“Most of our tax preparation services are in hospital’s primary care locations, because we know that’s where children and their families who need this help will be,” he says. “They get health care in those offices. This is another way of caring for them. At its base, our entire program is about connecting families with low and moderate incomes to tax credits that can help lift them out of poverty.”

There are many Volunteer Income Tax Assistance (VITA) clinics in the United States, largely administered through local United Way organizations. Nationwide Children’s partners with the United Way of Central Ohio for its tax clinics as well, but the volunteers and locations are supplied by the hospital.

All of the hospital’s tax preparation clinics are in neighborhoods that have traditionally had high infant mortality rates and are already part of the central Ohio’s CelebrateOne program to reduce infant mortality. Four are in Nationwide Children’s primary care offices. One is at Church and Community Development for All People (CD4AP) on the Columbus’s South Side; CD4AP has long been Nationwide Children’s partner in Healthy Neighborhood Healthy Families.

A sixth location is new, at Epworth United Methodist Church in Columbus’s Northland neighborhood. More information, including how to make appointments, is available at the project’s website.

While any refund is important for families, the ones available because of the federal Earned Income Tax Credit and the Child Tax Credit are most likely to make a material difference in people’s lives, says Miner. The Child Tax Credit was enhanced in 2021 as part of the American Rescue Plan and raised to $3,600 per year for qualifying children 5 years of age and younger and $3,000 for qualifying children 6-17 years old. The credit was also made fully refundable.

Many of the taxpayers served by the Nationwide Children’s program have less than $30,000 in annual gross adjusted income. At that income level, a family with children could have their annual income supplemented by 10%, 20% or more with the Child Tax Credit alone.

The enhanced credit and its potential extra documentation, though, may make the tax preparation process more complicated for some families, says Miner, which is all the more reason for them to take advantage of Nationwide Children’s services.

“We have 720 appointments available, and not many of them go unfilled,” he says. “We want to help as many people as we can.”