Why a Children’s Hospital Has Created Nation-leading Free Tax Return Clinics

Nationwide Children’s Hospital began its free tax return clinics in 2020 – part of its overall effort to improve the financial wellbeing of families in the community. That first year, a trial run during COVID-19, the hospital helped 54 families complete tax returns.

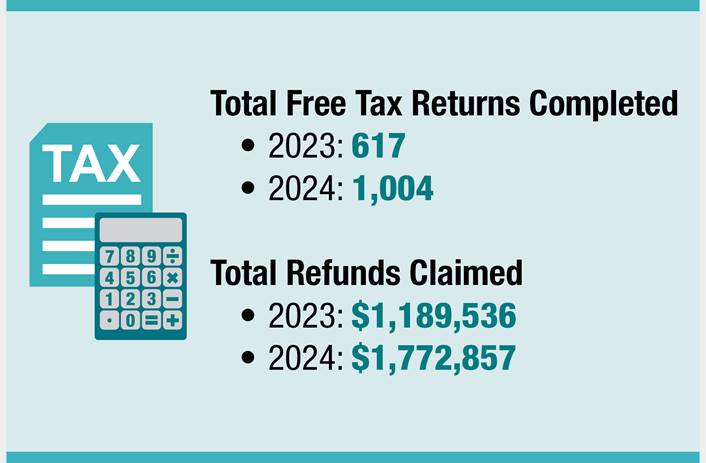

This year, 2024, the hospital helped more than 1,000 families earning less than $70,000 annually complete tax returns for free, allowing those families to claim nearly $1.8 million in refunds.

“This is the best program in the country at volunteer tax preparation from an academic medical center,” said Kelly Kelleher, MD, vice president of Community Health at Nationwide Children’s. “The people who have championed this work at the hospital have also collaborated with partners in rural communities to help stand up free tax assistance there. There’s really nothing else like this from a children’s hospital in the United States.”

Since 2020, families have claimed $5.4 million in refunds through the program in central Ohio. The actual financial impact potential exceeds $6.1 million, including the amount in filing fees that families have saved, said Ed Miner, who manages the tax clinic project.

“There are families who have thousands of dollars returned to them each year – that’s rent money, grocery money, money to buy a vehicle that families might not have been able to afford otherwise,” said Miner. “We can have a large impact on a family’s ability to live their lives.”

For nearly two decades, Nationwide Children’s has worked to affect the social determinants of health through its Healthy Neighborhoods Health Families initiative. The hospital has had particular success with high-quality affordable housing – nearly 800 units have been built or improved; with workforce development – hundreds of people hired from resource-challenged neighborhoods; and its groundbreaking efforts in school-based health, with clinics that saw more than 14,000 patient visits in 2023.

The free tax clinics are part of that same overall strategy, said Miner. Nationwide Children’s partners with the United Way of Central Ohio to place trained tax prep volunteers in sites that have heavy traffic from families who may qualify for free help, such as Nationwide Children’s Primary Care Centers.

There has been a particular focus on helping families claim Child Tax Credits and Earned Income Credits, which can be complicated for tax filers trying to complete returns on their own (or expensive for filers who are paying others for help). In 2024, families using the Nationwide Children’s free tax service claimed more than $1.1 million in those credits.

“Free tax preparation isn’t something you’d associate with a children’s hospital, but there is more to health than health care.” said Miner. “We are helping support people and neighborhoods in a holistic way.”

Published June 2024

“This is the best program in the country at volunteer tax preparation from an academic medical center. The people who have championed this work at the hospital have also collaborated with partners in rural communities to help stand up free tax assistance there. There’s really nothing else like this from a children’s hospital in the United States.”